2024년 첫 3분기 중국의 패스트너 수출 개요

데이터 관점에서 본 패스트너 수출: 패스트너 산업의 도전 과제

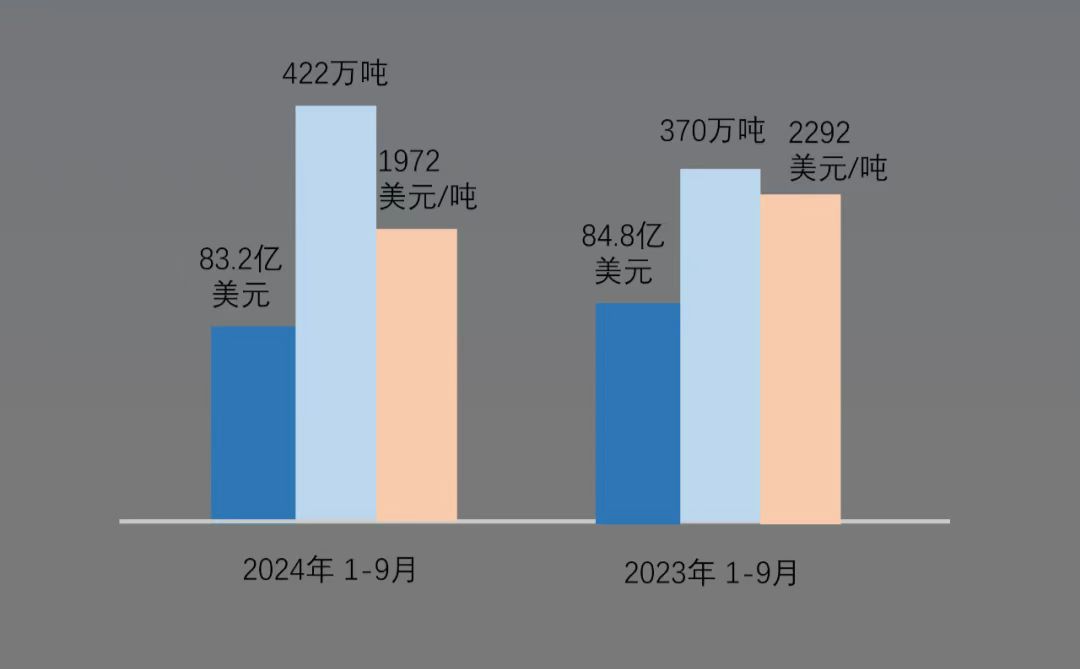

중국 해관 데이터에 따르면, 2024년 첫 3분기의 패스트너 수출 상황은 다음과 같습니다:

- 2024년 첫 3분기의 패스트너 총 수출액은 83억 2900만 달러로, 2023년 동기 대비 1.8% 감소했습니다.

- 수출량은 약 422만 톤으로, 2023년 첫 3분기 대비 14.2% 증가했습니다.

- 톤당 평균 단가는 2023년 동기 대비 14% 하락했습니다.

전반적으로, 글로벌 경제 성장률의 둔화는 많은 국가에서 고가의 패스트너에 대한 수요를 줄게 했습니다. 또한, 철강 및 비철금속과 같은 상류 원자재 가격의 하락은 평균 톤당 가격 감소의 주요 요인으로 작용했습니다.

2024년 전 3분기 중국 패스트너 산업 수출 현황

| 수출 금액 (USD) | 수출량 (톤) | 평균 톤당 가격 | |

|---|---|---|---|

| 2024년 1월-9월 | 8,329,548,646.00 | 4,222,520.09 | 1,972.65 |

| 2023년 1월-9월 | 8,479,822,977.00 | 3,698,182.49 | 2,292.97 |

| 전년동기대비 | -1.8% | +14.2% | -14.0% |

2024년 1-3분기 주요 수출국

| 수출 국가 | 2024년 1-3분기 수출액 (USD) | 2023년 1-3분기 대비 |

|---|---|---|

| 미국 | 1,245,534,765.00 | 8.6% |

| 베트남 | 411,571,625.00 | 15.7% |

| 러시아 | 409,856,467.00 | 15.3% |

| 독일 | 363,904,157.00 | -0.3% |

| 일본 | 315,035,378.00 | -4.5% |

| 대한민국 | 281,387,085.00 | -25.0% |

| 멕시코 | 259,594,707.00 | 0.8% |

| 인도 | 250,046,039.00 | -18.9% |

| 태국 | 243,932,200.00 | -12.5% |

| 사우디아라비아 | 230,819,667.00 | -15.6% |

| 브라질 | 205,662,548.00 | 18.6% |

| 이탈리아 | 192,652,924.00 | 14.4% |

| 폴란드 | 138,644,819.00 | 21.6% |

| 싱가포르 | 129,730,329.00 | 12.4% |

전 세계 경제의 영향으로 패스트너의 전체 수요가 감소했지만, 미국으로의 수출은 역행 상승했습니다. 지정학적 요인으로 인해 러시아는 큰 성장을 유지했으며, 무역 중계국 지위로 인해 베트남도 계속 성장하고 있습니다. 아시아에서는 국내 제조업이 약화됨에 따라 일본과 한국이 크게 하락한 반면, 인도는 점차 자체 산업 체인을 구축하여 중국산 패스트너의 수입 수요를 줄이고 있습니다. 카자흐스탄 등 중앙아시아 국가들은 여전히 성장의 핫스팟입니다. 특히 필리핀과 태국을 제외한 동남아시아(ASEAN) 국가들은 성장세를 보였으며, 캄보디아는 20% 이상의 성장률을 기록했습니다. 유럽에서는 독일과 프랑스 같은 전통적인 제조 강국들이 안정을 유지한 가운데, 폴란드와 체코 공화국 같은 중동유럽 국가들은 최근 1~2년간 중국과의 밀접한 경제 무역 관계 속에서 큰 성장을 보였습니다.

2024년 첫 세 분기 주요 성의 수출 상황

| 성/시 | 2024년 첫 세 분기 수출액 (USD) | 2023년 첫 세 분기 대비 변화 |

|---|---|---|

| 지강 성 | 3,272,113,363.00 | 4.5% |

| 장쑤 성 | 1,039,452,472.00 | -0.5% |

| 광동 성 | 840,267,410.00 | 2.7% |

| 산동 성 | 718,110,716.00 | -16.0% |

| 상해 | 693,289,289.00 | 3.4% |

| 허베이 성 | 385,719,583.00 | 0.7% |

| 톈진 | 223,540,892.00 | 0.8% |

| 푸젠 성 | 214,733,354.00 | -18.3% |

| 신장 위구르 자치구 | 130,331,187.00 | 28.2% |

| 광시 족 자치구 | 120,075,010.00 | 27.3% |

| 안후이 성 | 116,192,286.00 | 3.9% |

| 四川성 (Sichuan Province) | 109,114,649.00 | 9.3% |

| 베이징 | 99,653,342.00 | 14.1% |

| 후베이성 (Hubei Province) | 70,359,393.00 | -26.4% |

최대 5개의 수출성 중 절강성과 장쑤성은 여전히 선두를 유지했지만 광동성이 산동성을 제치고 3위로 올라섰다. 산동성의 수출은 -16%로 크게 감소했다. 한편, 중앙아시아와의 무역 호조에 힘입어 신장 지역은 계속해서 높은 속도로 성장했다. 남부 성들 중에는 광시 역시 중국-베트남 간 경제 및 무역 관계가 증가함에 따라 강한 성장을 보였다. (모든 데이터는 중국 해관에서 제공되었다.)

EN

EN