Overview of China’s Fastener Exports in the First Three Quarters of 2024

Data Perspective on Fastener Exports: Challenges in the Fastener Industry

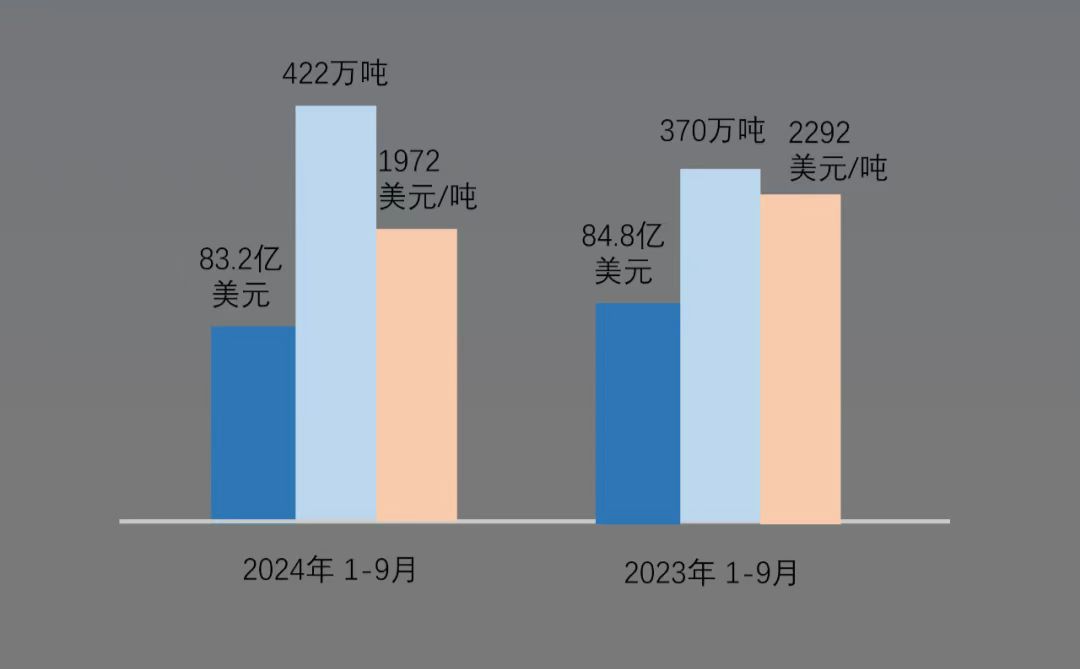

According to the data from the China Customs, the fastener export situation in the first three quarters of 2024 is as follows:

- The total export value of fasteners in the first three quarters of 2024 reached 8.329 billion USD, a decrease of 1.8% compared to the same period in 2023.

- The export volume was approximately 4.222 million tons, an increase of 14.2% over the first three quarters of 2023.

- The average unit price per ton fell by 14% compared to the same period in 2023.

Overall, the slowdown in global economic growth has led to a reduction in demand for high-value fasteners in many countries. Additionally, the decline in upstream raw material prices such as steel and non-ferrous metals has been a significant factor in the reduction of the average tonnage price.

Export Situation of China’s Fastener Industry in the First Three Quarters of 2024

| Export Value (USD) | Export Volume (tons) | Average Price per Ton | |

|---|---|---|---|

| January-September 2024 | 8,329,548,646.00 | 4,222,520.09 | 1,972.65 |

| January-September 2023 | 8,479,822,977.00 | 3,698,182.49 | 2,292.97 |

| YoY | -1.8% | +14.2% | -14.0% |

Main Export Countries in the First Three Quarters of 2024

| Export Country | Export Amount in the First Three Quarters of 2024 (USD) | Compared to the First Three Quarters of 2023 |

|---|---|---|

| United States | 1,245,534,765.00 | 8.6% |

| Vietnam | 411,571,625.00 | 15.7% |

| Russia | 409,856,467.00 | 15.3% |

| Germany | 363,904,157.00 | -0.3% |

| Japan | 315,035,378.00 | -4.5% |

| South Korea | 281,387,085.00 | -25.0% |

| Mexico | 259,594,707.00 | 0.8% |

| India | 250,046,039.00 | -18.9% |

| Thailand | 243,932,200.00 | -12.5% |

| Saudi Arabia | 230,819,667.00 | -15.6% |

| Brazil | 205,662,548.00 | 18.6% |

| Italy | 192,652,924.00 | 14.4% |

| Poland | 138,644,819.00 | 21.6% |

| Singapore | 129,730,329.00 | 12.4% |

Affected by the global economy, the overall demand for fasteners has slowed down. However, exports to the United States have increased against the trend. Due to geopolitical factors, Russia has maintained significant growth, and Vietnam has continued to grow due to its trade transit status. In Asia, Japan and South Korea have seen significant declines due to weak domestic manufacturing, while India has gradually established its own industrial chain, reducing its import demand for Chinese fasteners. Kazakhstan and other Central Asian countries continue to be growth hotspots. It is worth mentioning that ASEAN countries, except for the Philippines and Thailand, have seen growth, especially Cambodia, with an overall growth rate of over 20%. In Europe, traditional manufacturing powerhouses like Germany and France have remained stable, while Central and Eastern European countries like Poland and the Czech Republic, which have close economic and trade ties with China in the past one or two years, have seen significant growth.

Main Provinces’ Export Situation in the First Three Quarters of 2024

| Province/City | Export Value in the First Three Quarters of 2024 (USD) | Change from the First Three Quarters of 2023 |

|---|---|---|

| Zhejiang Province | 3,272,113,363.00 | 4.5% |

| Jiangsu Province | 1,039,452,472.00 | -0.5% |

| Guangdong Province | 840,267,410.00 | 2.7% |

| Shandong Province | 718,110,716.00 | -16.0% |

| Shanghai | 693,289,289.00 | 3.4% |

| Hebei Province | 385,719,583.00 | 0.7% |

| Tianjin | 223,540,892.00 | 0.8% |

| Fujian Province | 214,733,354.00 | -18.3% |

| Xinjiang Uygur Autonomous Region | 130,331,187.00 | 28.2% |

| Guangxi Zhuang Autonomous Region | 120,075,010.00 | 27.3% |

| Anhui Province | 116,192,286.00 | 3.9% |

| Sichuan Province | 109,114,649.00 | 9.3% |

| Beijing | 99,653,342.00 | 14.1% |

| Hubei Province | 70,359,393.00 | -26.4% |

Among the top five exporting provinces, Zhejiang and Jiangsu maintained their leading positions, but Guangdong Province surpassed Shandong to rank third. Shandong Province experienced a significant decline in exports, reaching -16%. Meanwhile, benefiting from the booming trade with Central Asia, Xinjiang continued to grow at a high speed. Among the southern provinces, Guangxi also witnessed a strong growth, synchronous with the increasing economic and trade relations between China and Vietnam. (All data is sourced from the China Customs.)

EN

EN